Ernst Junger Dieselpunk, Coordinate Grid Activities, Russian Revolution

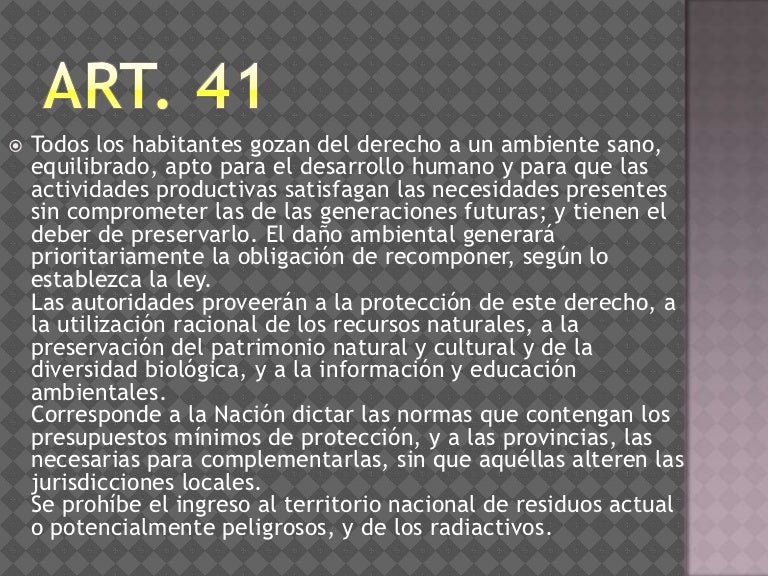

These new places of supply rules do not have any impact on the application of the exemption for transport and logistic services related to the importation and exportation of goods (transport, loading, unloading, packaging, inspection, customs formalities, storage, etc.) following article 41, §1, 2 ° and 3° of the Belgian VAT Code.

Portrait_2 Art of Isha

Non-submission and late submission of VAT returns: Non-submission of VAT returns is subject to a EUR 1,000 fine per return. Late-submission of VAT returns is subject to a EUR 100 per month capped at EUR 1,000. Reference to the above may be found in Article 70, §4 , and Article 53, §1, section 1, 2° of the Belgian VAT Code and VAT Royal.

Oriental Art

Algemene plaatsbepalingsregel voor btw Voor btw-doeleinden wordt een goederenvervoersdienst voor een btw-plichtige ontvanger geacht plaats te vinden in het land waar de btw-plichtige ontvanger gevestigd is. Dat is de toepassing van de algemene plaatsbepalingsregel (art. 21, §2 WBTW).

Dramaking Art

TITLE I. SUBJECT MATTER AND SCOPE. Article 1. 1. This Directive establishes the common system of value added tax (VAT). 2. The principle of the common system of VAT entails the application to goods and services of a general tax on consumption exactly proportional to the price of the goods and services, however many transactions take place in the production and distribution process before the.

Fan art 41 Anime Amino

Page 19 and 20: Art. 41, §1, 2° Wbtw: invoer In d; Page 21 and 22: Art. 41, §1, 3° Wbtw uitvoer Dien; Page 23 and 24: Art. 41, §1, 4° Wbtw goederen ond; Page 25 and 26: Periodieke btw-aangiften Maandaangi; Page 27 and 28: Periodieke btw-aangiften Rooster 00; Page 29 and 30: Periodieke btw-aangiften Nieuw roos

Ashikarin on Twitter "canon btw"

VAT obligation. Attention, please make an appointment to go to any of our offices. Declaration. VAT obligation. VAT obligation. VAT exemption scheme for small businesses. Rates and calculation. Partial VAT deduction. Accounting and invoicing.

art_41 Art, Darth, Darth vader

Het is derhalve noodzakelijk om door middel van een stelsel van belasting over de toegevoegde waarde (BTW) een harmonisatie van de wetgevingen inzake omzetbelasting tot stand te brengen die ten doel heeft, de factoren die de mededingingsvoorwaarden op nationaal of op communautair niveau zouden kunnen vervalsen, zoveel mogelijk uit te schakelen. (5)

Art Akarach

Tot deze datum is de btw-vrijstelling van artikel 41, §1, eerste lid, 3° WBTW van toepassing. De vervoersdienst die X levert aan A is ook onderworpen aan Belgische btw, maar wordt vrijgesteld op basis van artikel 41, §1, eerste lid, 3° WBTW. Heb je vragen over het einde van de btw-vrijstelling? Contacteer ons dan hier.

refresh on Twitter "Btw"

The right to deduct Although an intra-EU supply in these circumstances is normally exempt, the input VAT incurred on goods and services used for the purposes of making that supply may be deducted by the supplier ( Article 169 (b) VAT Directive ). This is because the corresponding acquisition is taxed. Example

ari on Twitter "orphy is also there btw!"

Zij zullen vanaf 1 april 2022 niet langer de btw-vrijstelling van artikel 41, §1, eerste lid, 3°W.BTW kunnen toepassen. Het onterecht toepassen van een vrijstelling zal immers aanleiding geven tot de navordering van btw, verhoogd met boeten en nalatigheidsinteresten. Pas dus tijdig uw systemen aan vanaf 1 april 2022.

Whatnot 🎨 Box Art Commission Stream 🎨 BIN Customs! Livestream by cam

More here: https://www.conciergeauctions.com/auctions/41-marguerite-drive-rancho-palos-verdes-california

Alexandra Wuyke Art

The proposal of Regulation of 4 October 2017 (COM (2017) 568) foresees, for the purposes of applying the VAT exemption indicated in the Art. 138 par. 1 of Directive 112/2006 (transposed in the Italian Law in the Art. 41 of Legislative Decree 331/1993), that goods are shipped or transported to another EU country, provided that at least one of.

Art 41

In such cases the VAT is usually reverse-charged to the client. This means that your client pays the VAT and not you. This applies in the following cases: Your client is an entrepreneur who is established in the Netherlands or who has a permanent establishment here. Your client is a legal entity (for example, a plc or a foundation) that is.

Cambodge Art

EU rules recognise 4 types of transaction on which VAT is chargeable ( Article 2 (1) VAT Directive ): Goods supplied in an EU country by a business ; Intra-EU acquisition of goods in an EU country by a business or a non-taxable legal entity such as a public body, in certain specified circumstances; Services supplied in an EU country by a business;

SteveSketches on Twitter "O, BTW, Sketchathon is tomorrow!"

Page 17 and 18: Vrijstellingen art. 41, §1 Wbtw Go; Page 19 and 20: Art. 41, §1, 2° Wbtw: invoer In d; Page 21 and 22: Art. 41, §1, 3° Wbtw uitvoer Dien; Page 23 and 24: Art. 41, §1, 4° Wbtw goederen ond; Page 25 and 26: Periodieke btw-aangiften Maandaangi; Page 27 and 28: Periodieke btw-aangiften Rooster 00; Page 29: Periodieke btw.

The Lost Art of Getting Around I Drive S.F.

In order to apply the VAT exemption for intra-Community supplies in Belgium (article 39bis of the Belgian VAT Code), Belgian VAT authorities require the supplier (amongst others) to obtain and keep a set of commercial documents that the goods have been transported from Belgium to another Member State.